Dealing with Debt – A Family’s Story (Part 1)

As Kathy pulled into the parking lot, she could see her daughter Sydney waiting by the door. It was a busy day for Kathy. She had to pick up Sydney from soccer practice, then run to the grocery store for a few items before picking up her other daughter, Colby, from her soccer practice.

As Sydney jumped into the car, she passed Kathy a letter she had received from her coach. Kathy glanced at the note quickly – Sydney’s soccer team was planning on going to a tournament that would cost each parent approximately $1200, plus travelling expenses.

Sydney was very excited and couldn’t wait to go, but Kathy felt a twinge in her stomach.

$1200?

How do they expect parents to come up with $1200 within two months, as if it was only $12?

As Kathy drove to pick up Colby from soccer practice, she couldn’t help but worry about what Colby’s soccer would cost this year.

The Costs Keep Coming

On top of the new furnace Kathy had to buy last month, there were $8000 in unplanned expenses in just the past two months. She was going to have to add all of those to her line of credit. That line of credit was already over $50 000, and her mortgage was at $250 000.

That meant Kathy’s mandatory payments were $3000 each month - and growing.

As far as putting money towards retirement or an emergency fund, that was completely out of the question. Every day felt like an emergency for Kathy, and it wasn’t getting any easier.

The last few years had been especially hard for Kathy and her family. Her husband John had died a couple of years ago from pancreatic cancer, and every time Kathy felt like she was getting ahead of debt, another bill or setback would push her back down again.

Kathy’s regular day job was as a teacher, but she had also started working as a waitress at a restaurant near her house. She was completely humiliated having to go back to the kind of work she did when she was in high school. Kathy prayed at the start of each shift that none of her students would come in, but the reality was that Kathy didn’t have time for pride.

She needed the money.

The Root of the Dilemma

Much of the difficulty was due to Kathy’s bank refusing to pay out the balance on Kathy and her late husband John’s line of credit, even though they had signed up for insurance. When Kathy and John took out the line of credit, John had agreed to the life insurance coverage the bank suggested.

The premiums seemed reasonable at the time, and the coverage would be necessary as the line of credit grew higher and higher. However, when John passed away and Kathy tried to collect the life insurance, she was told by the bank that John actually didn’t qualify.

He had incorrectly filled out something in the application.

It almost seemed cruel.

The bank eventually agreed to return the premiums Kathy and John had paid for, but that was of little use for Kathy.

Kathy thought, “what good is insurance if it isn’t there for you when you need it?”

In the end, there wasn’t much Kathy could do – hiring a lawyer and suing the bank was completely unrealistic. Kathy had to accept this twist of fate and move on.

-----

Mortgage insurance (also known as creditor insurance) is typically offered by your lending institution when you take out a mortgage or line of credit.

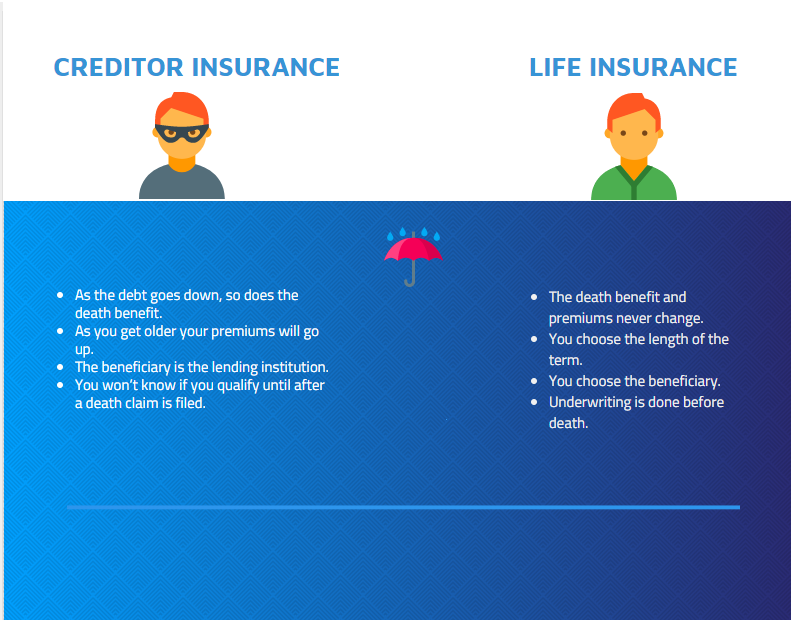

This is different than owning your own insurance policy through an insurance company. There are four major differences between creditor insurance and owning your own life insurance policy.

With creditor insurance the amount that is paid out is linked to the balance of the debt owing. As the debt goes down, so will the death benefit amount, but the premiums will remain the same. When you own your own insurance policy, the death benefit remains the same as do the monthly premiums.

Secondly, since most creditor or mortgage insurance is linked to a term, when the term expires your monthly premiums will most likely go up, since you are now older. The older a person is the more the monthly premiums are.

Third, for most creditor insurance the beneficiary is the lending institution (to pay off the outstanding loan). When you own your insurance policy, you have complete discretion on who you would like to name as the beneficiary.

Last, and most importantly, for most creditor insurance, underwriting is done after the fact. In other words, the insurance company will take a closer look at your case once a death has occurred and a claim is filed. In many cases, insurance companies have found that something might have been filled out incorrectly by the applicant and benefits are denied just when your family needs it the most.

What happened to Kathy also happened to a good friend of mine.

Hitting Bottom

As Kathy stepped inside her house, with an armful of groceries, the girls raced to their iPads. Kathy glanced at the mail and noticed a formal looking letter from her bank amongst the pile.

Kathy’s heartbeat quickened, as she hoped the bank had a change of heart and would be paying the insurance money she deserved. That hope quickly turned to panic as she started to read the letter. The bank was advising her that she had missed her last two mortgage payments and that if she didn’t come up with money quickly, they would begin foreclosure proceedings on her house.

How could this happen?

Kathy always made sure she had enough money for the mortgage payment. She raced to her computer and logged into her bank account. Sure enough, the bank was correct – she had missed two mortgage payments. Kathy knew she should check her bank account every week, but lately she was always too tired. Besides, it was a depressing chore that she admittedly had begun to avoid.

Well, now what?

Kathy didn’t know how she was going to fix this. She needed to start making supper, but she was too tired to care. She quietly headed upstairs to lie down and tried to forget everything for a while.

A Helping Hand

Eventually, Kathy was awoken by a text from her friend, Georgia. Georgia was inviting her to a wine tasting event the following Friday night. The event was being put on by Georgia’s financial advisor, Susan. Georgia was one of Kathy’s closest friends, but despite this, Kathy was too ashamed to discuss her financial issues with her friend.

Kathy just didn’t think Georgia would understand. Georgia was one of those people for whom things always seemed to just work out. Georgia and her husband made a lot of money, so it made sense that they had a financial advisor to invest all of the money they made. Since Kathy had no money to invest, why would she need a financial advisor?

However, the event was free, and Kathy really needed a night out to forget her troubles. She decided to accept Georgia’s invitation.

---------

Have you ever been in a position similar to Kathy? Or felt a similar feeling of helplessness as the bills roll in?

Debt affects every one of us – students, professionals, families, retirees. No one is immune to feeling the weight of “just trying to get by”.

It’s important to remember that common problems often have realistic solutions. There are ways to fix debt – sometimes you just need a helping hand.

In the story above, Kathy had just received her own helping hand. Where would it take her?

Stay tuned for the next part of the story – maybe you’ll get some ideas of your own out of it.

Thanks for reading,

Brent Misener, Misener Wealth

Brent Misener is a Financial Advisor with Raymond James Ltd. The views of the author do not necessarily reflect those of Raymond James. Statistics and factual data and other information are from source Raymond James Ltd. (RJL) believes to be reliable but their accuracy cannot be guaranteed. Information is furnished on the basis and understanding that RJL is to be under no liability whatsoever in respect thereof. It is provided as a general source of information and should not be construed as an offer or solicitation for the sale or purchase of any product and should not be considered tax advice. Raymond James advisors are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. Securities-related products and services are offered through Raymond James Ltd., Member - Canadian Investor Protection Fund. Insurance products and services are offered through Raymond James Financial Planning Ltd., which is not a Member - Canadian Investor Protection Fund.