Envisioning Your Retirement

When I do retirement projections with my clients, I ask them: “how much do you want to be able to spend in retirement?” Some have a fairly precise number, but most have no idea.

Inevitably, this leads to them asking me, “what do most couples spend?” Anyone who knows me would say that I’m hesitant to speak about averages, as they can often be misleading - especially when it comes to figuring out how much money you want to spend in retirement.

In particular, I encourage clients and friends to disregard what they read on the internet about requiring 70% of your gross income. This is generalized information and may or may not have anything to do with your individual situation.

Many years ago, I had a client who had done very well for himself in business. He could do pretty much anything he wanted in retirement but having a lot of money wasn’t his greatest asset.

His wisdom came from knowing exactly what he wanted and when enough was enough.

One reason many individuals may struggle with figuring out how much they need in retirement is that they have no idea what they currently spend right now. When you take this lack of understanding, coupled with a vague notion of what they might be doing in retirement, it’s no wonder why coming up with a number can be difficult.

If you’re serious about your retirement, than you should be serious about figuring it out. Here’s an exercise that you can do to help visualize your retirement. If you are married, then you should complete this exercise with your partner.

(By the way, I’ve seen many clients get into arguments right in front of me because both had vastly different visions of what their retirement should look like. This speaks to the importance of open and honest communication.)

Create a Vision Board

This exercise was adapted from the book, Picture Your Prosperity by Ellen Rogin and Lisa Kueng.

Creating a vision board can be far more engaging and fun than just going through your bank statements and tallying up what you spend each month. Knowing what, how much, and most importantly, why you spend your money on certain items is key to maintaining healthy cash flow.

If you have no idea how to answer these questions, then it’s a good bet that you might be having debt and cash flow issues. If that applies to you, then you should take the time to better understand your spending habits.

If your cash flow is positive each month and you want to focus on retirement planning, then a vision board is one of the most fun and proven methods to help you achieve your specified goals.

The first step is to find some pictures that represent the experiences and feelings you want to attract into your life. Some common examples are pictures of family, good health or anything else that bring you a sense of calm, serenity, or joy. You can draw the pictures if you like, cut pictures from magazines, or download pictures from the internet. It doesn’t matter where you get the pictures from; the important part is that they represent something meaningful you want to do in retirement.

For the images you have chosen, don’t worry about whether or not you’ll have the time or money to achieve your desired images.

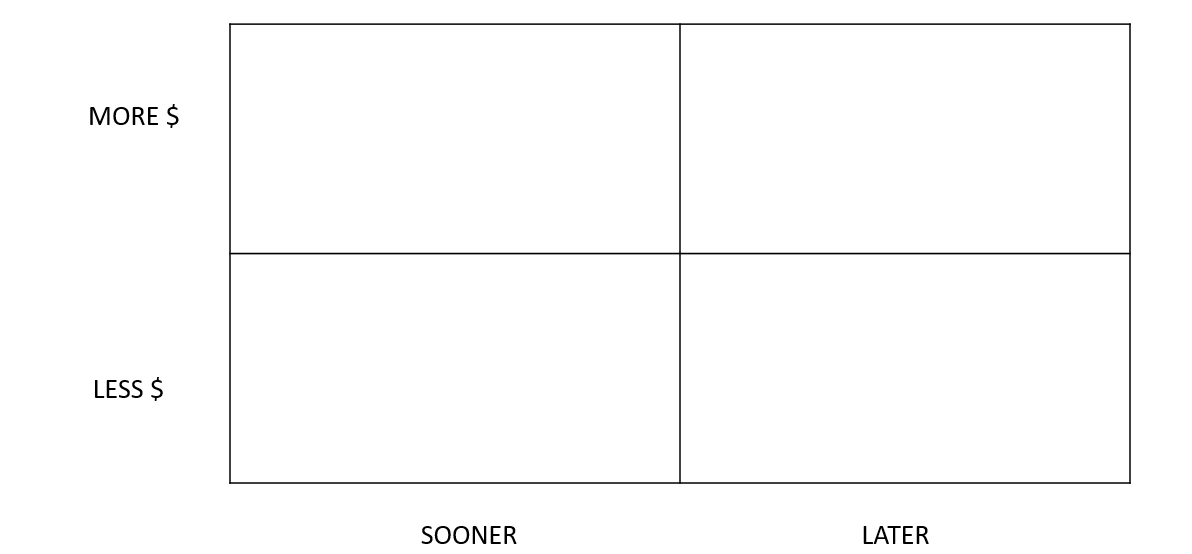

Once you have several pictures selected, place them in one of the four quadrants illustrated below. For example, if you choose a picture of an airplane (symbolizing travel) and you place it in the top right quadrant that means it is something you would like to do later in life, but it’s going to cost more money.

Perhaps one of your goals is to learn to play an instrument in retirement (a picture of a guitar, piano, etc.). You would most likely place this picture in the lower right quadrant indicating that it is something you want to do later in life, but it won’t cost a lot of money either.

Try and keep the images to four or five that are most important to you, so that the board doesn’t become too cluttered.

The second step is this: out of the images you have chosen, take a moment to relax and ask yourself some of the following questions:

- What does each image mean to you? Try and be as specific as possible.

- What are some of the details that you associate with each scene?

- Is there anyone there with you? If so, who?

- What noises do you hear in the background?

- And most importantly, what do you feel?

Don’t rush this part. Take your time and have fun with it. Allow yourself to dream big.

After this step, sit down with your advisor and carefully figure out what each of these goals are going to cost. For example, if travelling is important to you, you need to determine how much this will cost. Also, it’s important to be precise. Spending six months in Europe each year will cost far more than travelling to Las Vegas once a year. Or, learning how to paint is much less expensive than buying a cabin at the lake. Once you have the specific numbers, you can utilize this in your retirement planning software.

Lastly, the sooner you figure out how much you will need in retirement the easier it will be managing volatility in the market. I have found that once investors have a clear goal in mind of what they want to achieve, they are not swayed as much by the countless different events that can impact the market on a regular basis.

Have you ever tried creating a vision board? It’s the kind of activity you can’t knock until you try it, and it might help you achieve some real clarity for your future goals and plans.

Brent Misener is a Financial Advisor with Raymond James Ltd. The views of the author do not necessarily reflect those of Raymond James. Statistics and factual data and other information are from source Raymond James Ltd. (RJL) believes to be reliable but their accuracy cannot be guaranteed. Information is furnished on the basis and understanding that RJL is to be under no liability whatsoever in respect thereof. It is provided as a general source of information and should not be construed as an offer or solicitation for the sale or purchase of any product and should not be considered tax advice. Raymond James advisors are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. Securities-related products and services are offered through Raymond James Ltd., Member - Canadian Investor Protection Fund. Insurance products and services are offered through Raymond James Financial Planning Ltd., which is not a Member - Canadian Investor Protection Fund.